Ripple Vs. SEC: Sealed Remedies Reply Brief Filed, What To Expect Now

In

the

latest

from

the

XRP

lawsuit

between

Ripple

and

the

US

Securities

and

Exchange

Commission

(SEC),

the

agency

has

filed

its

remedies

reply

brief

under

seal,

signaling

a

significant

advance

in

the

case’s

remedies

phase.

This

stage

focuses

on

determining

the

potential

sanctions

that

the

fintech

company

might

face

if

the

SEC

is

successful

in

proving

its

allegations

that

Ripple

conducted

unauthorized

securities

transactions

involving

its

XRP

cryptocurrency.

Ripple

Vs.

SEC:

Detailed

Timeline

And

Upcoming

Events

James

K.

Filan,

a

former

defense

lawyer

closely

monitoring

the

case,

updated

the

XRP

community

via

X

(formerly

Twitter),

stating,

“The

SEC

has

filed,

under

seal,

its

remedies

reply

brief

&

supporting

exhibits.

These

documents

are

not

yet

public.

Public,

redacted

versions

will

be

filed

by

Wednesday,

May

8,

2024.

Other

sealing-related

filings

will

follow.”

This

filing

is

a

crucial

procedural

step

in

the

ongoing

litigation,

initiating

a

series

of

legal

maneuvers

centered

around

the

confidentiality

and

disclosure

of

sensitive

materials.

Following

yesterday’s

sealed

filing,

Ripple

and

the

SEC

will

meet

today,

May

7,

to

discuss

and

determine

the

necessary

redactions

to

the

reply

brief

and

related

documents,

involving

both

parties

and

any

third

parties.

This

session

aims

to

determine

what

information

remains

under

seal

and

what

will

be

made

accessible

to

the

public.

Tomorrow,

on

May

8,

the

SEC

is

scheduled

to

release

a

public,

redacted

version

of

the

reply

brief

along

with

any

supporting

exhibits

not

designated

as

Confidential

or

Highly

Confidential

under

the

current

Protective

Order.

This

release

will

only

include

those

provisional

redactions

requested

during

the

May

7

meet

and

confer.

Further

sealing

motions

are

planned

for

May

13,

where

all

involved

parties

and

third

parties

will

file

omnibus

letter-motions

to

seal

all

materials

related

to

the

remedies-related

briefing.

This

includes

briefs,

declarations,

and

supporting

exhibits,

followed

by

the

submission

of

proposed

redactions

to

these

materials.

On

May

20,

oppositions

to

the

May

13

sealing

motions

are

due.

The

process

stipulates

that

parties

are

also

required

to

file

public,

redacted

versions

of

all

documents

within

14

days

following

the

court’s

decisions

on

the

omnibus

sealing

motions.

Financial

Stakes

And

Ripple’s

Defense

The

stakes

are

notably

high,

with

the

SEC

seeking

fines

and

penalties

totaling

around

$2

billion.

Ripple’s

counter-proposal

suggests

a

maximum

penalty

of

just

$10

million.

The

fintech

firm

argues

against

the

SEC’s

proposed

injunction,

maintaining

that

it

has

instituted

significant

changes

to

avert

future

infractions.

Ripple’s

opposition

to

the

SEC’s

demand

for

disgorgement

is

based

on

the

claim

that

the

regulator

has

not

substantiated

that

Ripple’s

activities

caused

monetary

losses

to

institutional

investors.

Regarding

civil

penalties,

Ripple

calls

for

a

substantial

reduction,

arguing

that

the

SEC’s

demands

are

disproportionate

compared

to

penalties

imposed

in

similar

cases.

Currently,

a

critical

battle

is

unfolding

over

the

testimony

of

expert

witness

Andrea

Fox.

Ripple

disputes

the

SEC’s

characterization

of

Fox’s

expert

declaration.

Ripple’s

objection

suggests

that

the

SEC’s

categorization

of

the

testimony

is

flawed.

Jeremy

Hogan,

a

legal

expert

from

the

XRP

community,

commented

recently

on

the

matter

via

X,

saying,

“I

think

the

SEC

will

win

this

motion.”

He

noted

that,

based

on

past

case

outcomes,

the

court

is

likely

to

recognize

Fox

as

an

expert,

thus

permitting

Ripple

to

depose

her

rather

than

striking

her

testimony

from

the

record.

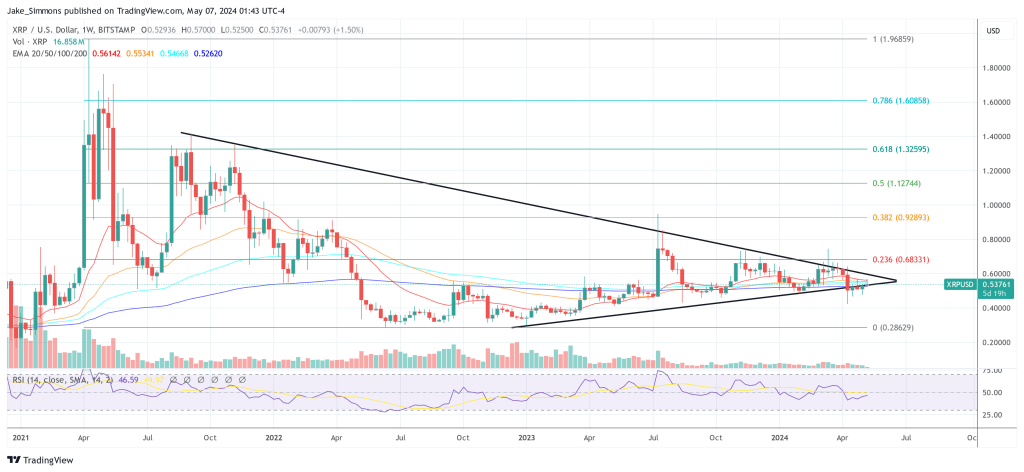

At

press

time,

XRP

traded

at

$0.53761.

price,

1-week

chart

|

Source:

XRPUSD

on

TradingView.com

Featured

image

from

Shutterstock,

chart

from

TradingView.com

Comments are closed.