Marathon Digital Mints Massive Market Cap Gain: Up $800 Million

Bitcoin

mining

company

Marathon

Digital

(MARA)

is

basking

in

the

glow

of

a

successful

week,

with

its

stock

price

surging

after

inclusion

in

the

prestigious

S&P

SmallCap

600

index

and

the

announcement

of

a

performance-based

executive

bonus

plan.

However,

the

company’s

fortunes

remain

tethered

to

the

ever-volatile

Bitcoin

price.

S&P

Inclusion

Boosts

Visibility

And

Investor

Confidence

The

inclusion

in

the

S&P

SmallCap

600

index

marks

a

significant

milestone

for

Marathon

Digital.

This

widely

tracked

index

exposes

the

company

to

a

broader

pool

of

investors

who

base

their

investment

decisions

on

index

holdings.

The

news

triggered

an

18%

jump

in

Marathon

Digital’s

stock

price,

reaching

$20.67

per

share,

according

to

Yahoo

Finance

data.

This

surge

reflects

investor

confidence

in

the

increased

visibility

and

potential

for

more

significant

investments.

Being

added

to

the

S&P

SmallCap

600

is

a

validation

of

Marathon

Digital’s

position

as

a

leading

player

in

the

cryptocurrency

mining

industry.

This

inclusion

will

enhance

the

company’s

standing

and

attract

a

new

wave

of

investors

seeking

exposure

to

the

Bitcoin

mining

space.

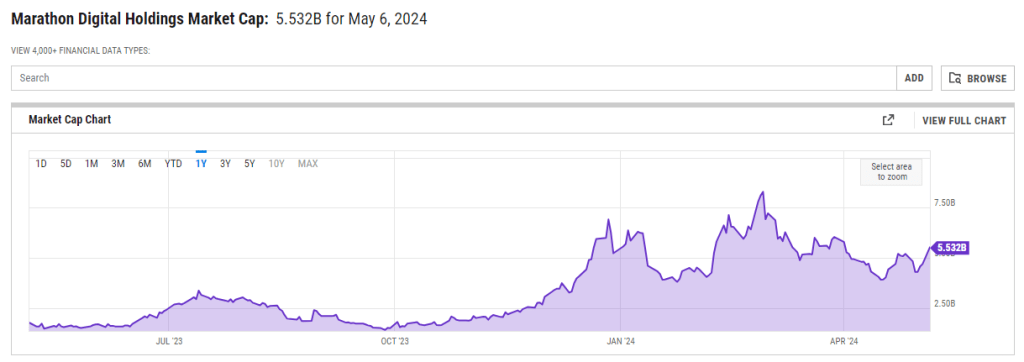

Source: YCharts

Executive

Bonus

Plan

Aligns

Interests

With

Shareholders

Adding

to

the

positive

momentum,

Marathon

Digital

unveiled

a

new

executive

bonus

plan

directly

linked

to

the

company’s

stock

price

performance.

This

strategic

move

aligns

the

interests

of

top

executives,

including

CEO

Fred

Thiel,

CFO

Salman

Khan,

and

General

Counsel

Zabi

Nowaid,

with

those

of

shareholders.

Bonuses

of

up

to

nearly

$33

million

can

only

be

awarded

if

the

stock

price

performs

well,

incentivizing

executives

to

make

decisions

that

drive

shareholder

value.

Total crypto market cap currently at $2.282 trillion. Chart: TradingView

The

executive

bonus

plan

demonstrates

the

management

team’s

confidence

in

Marathon

Digital’s

future

growth

trajectory.

Tying

bonuses

to

stock

price

performance

ensures

that

executives

are

focused

on

strategies

that

will

benefit

shareholders

in

the

long

run.

Bitcoin

Price

Volatility:

A

Double-Edged

Sword

While

the

S&P

inclusion

and

bonus

plan

are

positive

developments,

Marathon’s

fortunes

remain

intricately

tied

to

the

price

of

Bitcoin.

The

article

mentions

Bitcoin

hovering

around

$63,200,

with

increased

trading

volume

but

a

bearish

trend

over

the

past

24

hours.

This

volatility

presents

a

double-edged

sword

for

Marathon

Digital.

A

sustained

rise

in

Bitcoin

price

would

significantly

benefit

the

company,

as

its

mining

operations

become

more

profitable.

However,

a

prolonged

slump

could

put

a

damper

on

Marathon

Digital’s

growth

prospects.

Investors

considering

Marathon

Digital

as

an

investment

should

carefully

consider

their

risk

tolerance

regarding

Bitcoin’s

price

fluctuations.

Looking

Ahead:

Marathon

Digital

Charts

A

Growth

Path

Despite

the

inherent

risks

associated

with

Bitcoin

price

swings,

Marathon’s

recent

developments

paint

a

promising

picture

for

the

company’s

future.

The

S&P

inclusion

broadens

its

investor

base,

and

the

executive

bonus

plan

incentivizes

leadership

to

focus

on

shareholder

value

creation.

As

the

cryptocurrency

mining

industry

continues

to

evolve,

Marathon

Digital

is

well-positioned

to

capitalize

on

growth

opportunities,

provided

it

can

navigate

the

unpredictable

tides

of

the

Bitcoin

market.

Featured

image

from

Marathon

Digital/X,

chart

from

TradingView

Source:

Source:

Comments are closed.