The Next Big Catalyst For Bitcoin? What Michael Saylor Predicts

In

an

interview

with

journalist

Natalie

Brunell,

Michael

Saylor,

executive

chairman

and

co-founder

of

MicroStrategy,

laid

out

his

vision

for

what

could

next

propel

the

price

of

Bitcoin.

His

insights

come

at

a

time

when

the

digital

currency

landscape

is

experiencing

pivotal

regulatory

and

institutional

developments.

The

Next

Big

Catalyst

For

Bitcoin

Price

Saylor

pinpointed

the

specific

moment

he

believes

heralded

the

onset

of

a

new

era

for

Bitcoin.

“January

of

2024

marked

the

beginning

of

the

period

of

corporate

adoption

of

Bitcoin,”

he

stated.

The

significance

of

this

shift,

according

to

Saylor,

is

tied

closely

to

regulatory

approvals

and

the

distinctive

path

Bitcoin

is

carving

for

itself

amidst

a

sea

of

digital

assets.

The

crux

of

Saylor’s

argument

is

the

US

Securities

and

Exchange

Commission’s

(SEC)

decision-making

process

regarding

cryptocurrency

spot

Exchange-Traded

Funds

(ETFs).

He

described

the

SEC’s

approval

of

Bitcoin

spot

ETFs

as

the

“first

big

catalyst.”

This

regulatory

nod

not

only

legitimizes

Bitcoin

in

the

eyes

of

institutional

investors

but

also

enhances

its

appeal

as

a

viable

corporate

treasury

asset.

Now,

Saylor

argues

that

the

next

decisive

moment

will

hinge

on

the

SEC’s

handling

of

other

cryptocurrencies.

“The

second

big

catalyst

will

be

the

SEC’s

denial

of

every

other

crypto

application

for

spot

ETFs,”

Saylor

explained.

By

denying

these

applications,

the

SEC

would

effectively

position

Bitcoin

as

the

premier,

unreplicated

choice

among

cryptocurrencies,

an

outcome

Saylor

sees

as

critical

for

dispelling

doubts

about

Bitcoin’s

long-term

viability

and

uniqueness.

“And

when

we

actually

see

the

regulators

deny

the

applications

of

the

copies

of

other

crypto

assets,

then

we

will

have

checked

the

box.

It

won’t

be

banned,

it

won’t

be

copied,”

Saylor

remarked.

Expanding

on

the

implications

of

such

regulatory

decisions,

Saylor

employed

a

metaphor

involving

the

choice

of

materials

in

large-scale

engineering

projects.

He

compared

the

decision-making

process

in

corporate

investment

in

Bitcoin

to

choosing

between

steel

or

bronze

for

constructing

a

skyscraper.

“Once

you

realize

there’s

just

steel

and

there

is

no

second

best

metal

for

structural

civil

engineering,

the

project

moves

forward,”

he

noted.

In

this

analogy,

Bitcoin

is

likened

to

steel

—

the

foundational

material

without

substitute

—

clearing

any

hesitation

about

its

adoption

in

corporate

portfolios.

Should

we

be

watching

for

another

catalyst

that

will

spur

more

#Bitcoin

adoption?“The

first

big

catalyst

was

the

SEC’s

approval

of

spot

#ETFs

for

Bitcoin…the

second

big

catalyst

is

going

to

be

the

SEC’s

denial

of

every

other

#crypto

application

for

a

spot

ETF…”

–@saylor…

pic.twitter.com/4aKarg6eAS—

Natalie

Brunell

⚡️

(@natbrunell)

May

6,

2024

Notably,

this

narrative

is

timely

as

the

crypto

sector

watches

the

SEC

closely,

particularly

with

regard

to

Ethereum,

the

second-largest

cryptocurrency

by

market

cap.

The

final

deadline

for

the

SEC

to

approve

or

deny

the

VanEck

spot

Ethereum

ETF

is

May

23,

2024,

a

decision

that

has

been

postponed

repeatedly.

Bloomberg’s

senior

ETF

analyst,

Eric

Balchunas,

noted

a

decrease

in

the

likelihood

of

approval

in

March,

citing

a

lack

of

communication

between

the

SEC

and

ETF

applicants,

which

he

viewed

as

a

negative

signal

for

Ethereum’s

immediate

ETF

prospects.

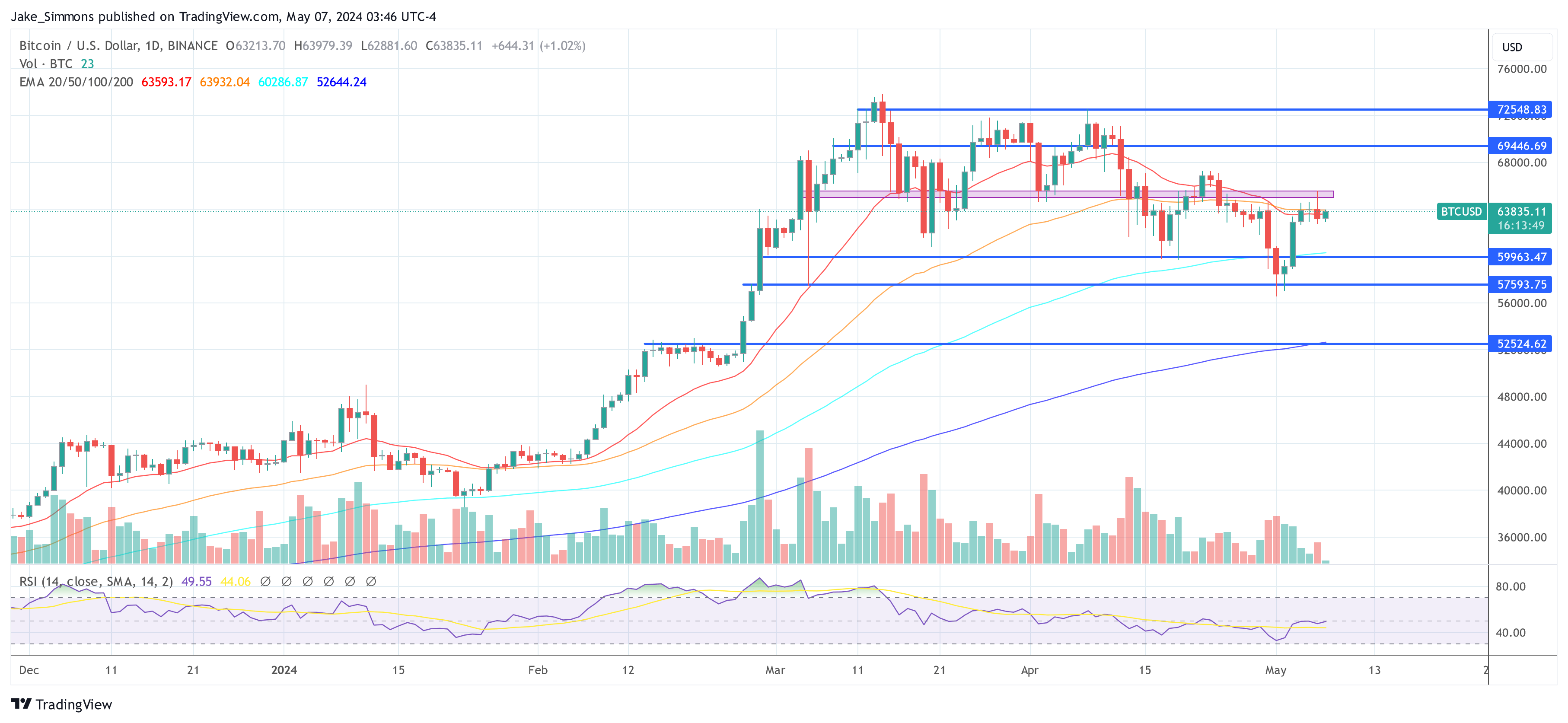

At

press

time,

BTC

traded

at

$63,835.

price,

1-day

chart

|

Source:

BTCUSD

on

TradingView.com

Featured

image

from

tesmanian,

chart

from

TradingView.com

Disclaimer:

The

article

is

provided

for

educational

purposes

only.

It

does

not

represent

the

opinions

of

NewsBTC

on

whether

to

buy,

sell

or

hold

any

investments

and

naturally

investing

carries

risks.

You

are

advised

to

conduct

your

own

research

before

making

any

investment

decisions.

Use

information

provided

on

this

website

entirely

at

your

own

risk.

Comments are closed.